NASHVILLE, Tennessee – A bill that would have shed light on taxpayer funded payments by Tennessee state and local governments to private entities was killed at its first stop in the House Public Service & Employees Subcommittee.

By an obvious voice vote on HB 0370, Chairman Bob Ramsey (R-Maryville) ruled that the Nays prevailed.

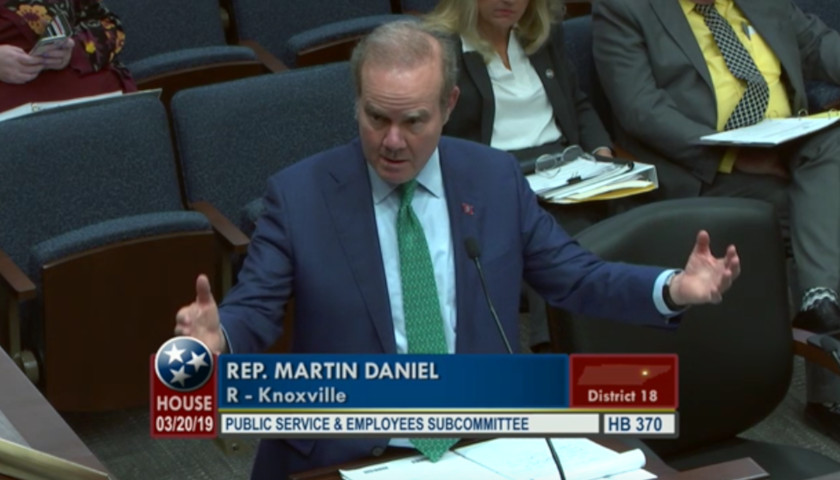

In his introduction of the bill, Representative Martin Daniel (R-Knoxville) told the subcommittee members, “The intent of this bill is to require disclosure – to shine a light, if you will – on what our government entities are paying for goods and services.”

Representative Daniel told the committee, “I would submit that transparency and accountability in government instills public trust in government.”

“However, vague and broad exceptions to the (Tennessee) Public Records Act concerning what a private entity might deem to be trade secrets or confidential information can obscure information concerning benefits that are conveyed by government entities to these privately-owned recipients,” continued Daniel.

To clarify, Daniel emphatically stated, “This bill would not act on or touch such information” that may actually be confidential and disclosed by the private entity in connection with receiving government payments, benefits or properties.

“It is we,” Daniel fervently stated, emphasizing “we” and holding out his hands out to indicate the committee members, “the legislature – representative of the people – who should declare what is confidential and a trade secret, not these private entities who are receiving government benefits.”

Chairman Ramsey stated as his understanding, the initial impetus for the bill was an agreement “that has apparently been shrouded in mystery with Google.”

The committee heard testimony from Deborah Fisher, Executive Director, Tennessee Coalition for Open Government (TCOG), which is a “non-profit entity established in 2003 that is committed to preserving transparency in government,” as she introduced herself.

Fisher more or less confirmed, “This issue really came on our radar about two years ago,” in conjunction with the Google deal in Clarksville, Montgomery County. She continued with a statement explaining the background on the bill,

The Tennessee Public Records Act states that a public record is any record made in connection with the transaction of official business by a government agency.

And most Tennesseans would just assume that this means that how much a government entity pays a private entity is public. And when a government entity grants a company a financial benefit, such as property in a PILOT (payment-in-lieu-of-taxes) agreement, that the value of that PILOT agreement would be public.

But ,what we have seen is that this has been undercut where businesses have asserted that in fact, the value of the property — and this is what happened with Google in Montgomery County — but the value of the property that they were given by the government to operate on in the PILOT was confidential because Google said if other companies knew how much we were getting from the government they would compete against us more effectively.

And so they were effective in basically removing that from the public record. And that’s really our concern here — is the ability of businesses to remove from the public record the value, the amount that is being paid in payments to private entities, or the value of government property that has been assembled using taxpayer funds, the ability of businesses to claim that’s a trade secret and remove that information permanently from the public record where the public doesn’t know that.

And that’s really how it arose.

Fisher then concluded, “The language in this bill would be affirmative language in the (Tennessee) Public Records Act that would just sort of draw the line in the sand on that.”

Chairman Ramsey expressed his understanding of that, and said, “I think all of us can be sympathetic to that concept.”

As Bradley Jackson, President and CEO of the Tennessee Chamber of Commerce & Industry stood in the back of the room nodding his head in agreement, Ramsey continued, “But, this bill seems to be a bit more far reaching, and I’m getting communication from my chambers of commerce.”

Said Ramsey, “Even though it doesn’t affect them, it does affect recruitment. The atmosphere for Tennessee to recruit entities outside the state, and so it creates a certain atmosphere.”

Representative David Hawk (R-Greenville) continued on the same theme, saying he is trying to get his mind wrapped around his concern that if we do this, and other states in the country are not doing this, it does create a disadvantage.

Other subcommittee members, Representative Gary Hicks (R-Rogersville) and Harold Love (D-Nashville), expressed concern about contributors to higher education endowments or their foundations, even though the legislation specifically addressed a government payment, fee or other financial benefit paid from a government entity to a private entity (emphasis added).

Committee Attorney, Matt Mundy, added to the discussion saying that as he understands it, “if the endowments were already protected under specific exceptions – so they’re currently not public record – then this would not apply to them. But if it’s a public record, it’s a public record. It’s almost a clarification. Unless you have a specific exception under existing law, then the information needs to be public.”

On the topic of exceptions to the state’s public record laws, known collectively as the Tennessee Public Records Act, there are 564 exceptions as of August 2018, up from 538 in January 2018, according to a report from the state’s Office of Open Records Counsel (OORC). The additional 26 exceptions came about during the short period of the second session of the 110th Tennessee General Assembly.

The OORC created an on-line public and searchable database of the current 564 exceptions, although it does not include other exceptions that may be found in Tennessee court rules, federal law, common law or agency rules.

The Office reports that the number of exceptions has grown substantially over the years, from two when the Tennessee Public Records Act was enacted in 1957, to 89 about 30 years later in 1988 and now up to 564 about another 30 years later.

In particular, Amazon and Google, both of which have been looking at large expansions outside their respective home bases, have come under scrutiny and criticism for some of their business practices, have made deals within the state of Tennessee and have forced unprecedented secrecy around their deals with government entities within and outside the state.

With regard to the Amazon deal in Virginia announced last year, the Washington Post reported at the time, “One provision in Virginia’s package is not financial at all. Virginia agreed to give Amazon at least two days notice if the media or the public filed a Freedom of Information Act request about the agreement. This would ‘allow the Company to seek a protective order or other appropriate remedy.’”

A more recent Washington Post article slammed Google for the way it has reaped millions in tax breaks as it secretly expanded across the U.S. The article stated that Google’s nondisclosure agreements appeared one-sided, protecting Google’s interests above those of the city or the public, according to Michelle Wilde Anderson, a Stanford Law School professor specializing in state and local government law.

Montgomery County, Tennessee resident, Steven Currie, who has concerns about the local deal with Google, attended the subcommittee hearing on House Bill 0370 and hoped to testify in favor of it. He later told The Tennessee Star that “Part of the problem is that all of these deals are usually kept quiet until after the contracts are signed” and called the practice of claiming it as a trade secret “absurd.”

“This is what leads to that debacle in Memphis with Electrolux,” Currie told The Star about the deal that included at least $188.3 million in subsidies according to the Commercial Appeal and then suddenly closed.

On the Clarksville-Montgomery County Google deal, in The Leaf-Chronicle report, “Secrecy, incentives were necessary part of Google deal,” the new chief executive officer of the Clarksville-Montgomery County Economic Development Council, Jeff Truitt, says that public nondisclosure and incentives were a necessary part of attracting the $600 million Google data center to Clarksville, but residents here can feel good about the deal and end result.

The report provided further detail about the Google arrangement, “The agreement also required the city to ‘promptly notify Google upon receipt of any public/open records law request for any confidential information,’ and that “the Clarksville agreement required the city to contest disclosures and allow Google to ‘assume control’ over the city’s actions and decisions.”

It is unclear how residents of Clarksville-Montgomery County can “feel good about the deal,” as Truitt said, when they don’t know and can’t possibly find out the details of the deal.

A government entity’s willing participation in the use of ‘”trade secret” practices either allows a private entity to dictate a government entity’s public records policy or, more insidiously, gives cover to a government entity that does not want the details of a deal to become subject to public review and scrutiny.

– – –

Laura Baigert is a senior reporter at The Tennessee Star.